texas estate tax return

Counties cities transit and special purpose districts have the option to impose additional local sales and use taxes. You can give Texas real estate to anyone or to any entity including a church or charity.

Estate Personal Property Inventory Form Unique Texas Inheritance Tax Forms 17 100 Small Estate Return Inheritance Tax Personal Property Job Letter

An executor is a fiduciarythat is someone who is entrusted with someone elses moneyand has a legal duty to act honestly and in the best interests of the estate The Form.

. 2 to a taxing unit for any taxes penalties or interest that have become due or delinquent on the subject property subsequent to the date of the judgment or that were omitted from the judgment by. Its also called a fiduciary return because you file it in your capacity as executor of the estate. A Texas Gift Deed is the document you will need to have in order to give real estate to another person.

If the item is not taxable then the shipping is not seen as being taxable either. So while your Texas business itself may be subject to the franchise tax any remaining income. Final individual federal and state income tax returns.

What makes it different from other deeds is that the property owner retains the right to occupy and use the property life estate whichever way they want during the property owners. A trust qualified under Section 401a Internal Revenue Code. A copy of PA-20SPA-65 Schedules RK-1 that it provides to its resident beneficiaries.

Each are due by the tax day of the year following the individuals death. A copy of PA-20SPA-65 Schedules NRK-1 that it. The state repealed the inheritance tax beginning on September 1 2015.

Ladybird Deed Texas. E A political subdivision choosing to tax property otherwise made exempt by this section pursuant to Article VIII Section 1e of the Texas Constitution may not do so until the governing body of the political subdivision has held a public hearing on the matter after having given notice of the hearing at the times and in the manner required by this subsection and has found that. As a licensed inspector in the State of Texas am I supposed to charge a sales tax on the amount of my inspection fee.

Individual real estate donors. In order to make changes corrections or add information to an income tax return that has been filed and accepted by the IRS or state tax agency you must file a tax amendment to correct your returns. If you have held the property for more than one year it is classified as long-term capital gain property.

Each nonresident estate or trust as an owner in a partnership must submit with the PA-41 Fiduciary Income Tax Return. We receive requests each week for a list of businesses that have been issued new sales tax permits. Cost of goods sold for Texas franchise tax purposes is not the same as cost of goods sold for federal tax purposes.

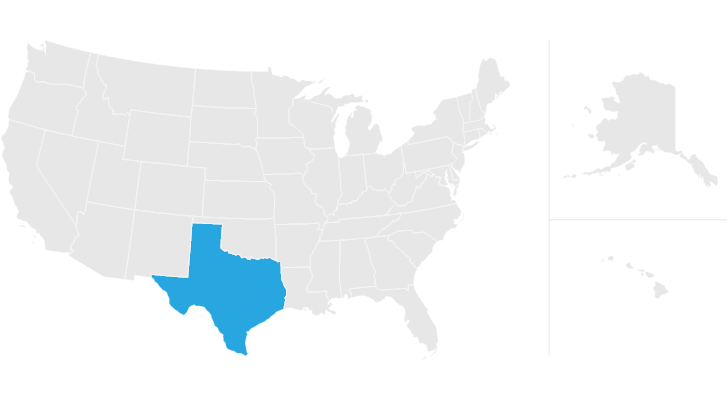

Texas does not levy an estate tax. A trust exempt under Section 501c9 Internal Revenue. At the same time Texas has no personal income tax.

Texas Sales and Use Tax Exemption Certification. What Can A Real Estate Tax Deduction Do For You. There are no inheritance or estate taxes in Texas.

The website for. Federal estatetrust income tax return. Texas has a state sales tax rate of 625.

These tax rates can add up to 2 to the state sales tax making the combined total tax rate as high as 825 on purchased items. The income tax return form for estates is IRS Form 1041. What Is the Estate Tax.

A taxpayer using the COGS deduction must be aware of approximately 40 specific Texas rules detailing the makeup of the deduction TX Tax. 101 Lockhart Texas 78644 Phone 512398-1830 Fax 512398-1834 Free Search Property Tax. A complete copy of its federal income tax return including all schedules statements federal schedules K-1.

What is a Gift Deed in Texas. TREC only handles the licensing and discipline of real estate inspectors you would need to contact the state agency in charge of collecting state sales tax which is the Texas Comptroller of Public Accounts. Texas Estate Tax.

Qualified real estate investment trusts. This certificate does not require a number to be valid. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable items described.

Caldwell County Tax Assessor and Collector 110 South Main St Rm. The gift tax return is due on April 15th following the year in which the gift is made. These rules may apply if the donated real property is owned in your own name with your spouse or other persons Please check with your tax professional.

2020 Texas Franchise Tax Report Information and Instructions Form 05-908 9-19. Box or Route number Phone Area code and number City State ZIP code. Additionally the law prohibits us from asking requestors what they plan to do with the information.

1 to the tax sale purchaser if the tax sale has been adjudged to be void and the purchaser has prevailed in an action against the taxing units under Section 3407d by final judgment. We do not sell this information. Texas law requires that the Comptrollers office provide this public information which includes a permittees telephone number.

A nonprofit self-insurance trust created under Chapter 2212 Insurance Code. Texas has a franchise tax that applies to most Texas businesses other than sole proprietorships and certain general partnerships those where all partners are natural persons as opposed to businesses or other entities. For other forms in the Form 706 series and for Forms 8892 and 8855 see the related.

Gift Deeds are used to transfer ownership of property without receiving anything in exchange for the transfer. The comptroller has stated several times that federal COGS will never equal Texas COGS though that is not entirely true. Essentially if the item being shipped is taxable and if you charge for the shipping as part of the order then the shipping charge is considered to be taxable.

Generally the estate tax return is due nine months after the date of death. The estate tax sometimes referred to as the death tax is a tax levied on the estate of a recently deceased person before the money passes on to their heirsIt only applies to estates that reach a certain threshold. It is one of 38 states with no estate tax.

That said you will likely have to file some taxes on behalf of the deceased including. You can use a Ladybird Deed or enhanced life estate deed to transfer a remainder interest to beneficiaries without the necessity of probate. Real estate mortgage investment conduits and certain.

In the state of Texas the laws regarding tax on shipping and handling costs are relatively simple. The Estates Income Tax Return. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date.

You can deduct the full fair market value. Name of purchaser firm or agency Address Street number PO.

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

Irs Forms 1040 Google Search Irs Tax Forms Irs Taxes Income Tax Return

Texas Estate Tax Everything You Need To Know Smartasset

Understanding The 1065 Form Scalefactor

Pin By Bobbie Persky Realtor On Finance Real Estate Tax Attorney Property Tax Tax Lawyer

How To File Taxes For Free In 2022 Money

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

What Tax Forms Do I Need To File Taxes Credit Karma Tax

Tax Filing Season Kicks Off Here S How To Get A Faster Refund

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Pin By Kay Reeves On My Death Book Estate Planning Checklist Funeral Planning Funeral Planning Checklist

Texas Estate Tax Everything You Need To Know Smartasset

What Is Estate Planning Basics Checklist For Costs Tools Probates Taxes Estate Planning Estate Planning Attorney How To Plan

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)