how does hawaii tax capital gains

The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries. According to Hawaiis capital gains tax a capital gain is taxed at the highest level.

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

What this does is defer the capital gain on the original property carry over that cost basis and when the second one is sold.

. Capital gains result when an individual sells an investment for an amount greater than their purchase price. Capital Gains Tax Rate. During the first year of tax-paying there is a 10 tax rate.

Uppermost capital gains tax rates by state 2015 State State uppermost rate Combined uppermost rate Hawaii. Tax Foundation The High Burden of State and Federal Capital Gains Tax Rates accessed October 26 2017. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate.

In addition it would impose a 10 tax on income. A valuation table at FBR sets forth a fair value basis for. In calculating the amount you have to pay to tax on the gains a lot relies on how long you had the item before.

Chris Rock once remarked You dont pay taxes they take taxes 1 That applies not only to income but also to capital gains. How Is Gain Tax Calculated On Property. Capital Gains Tax in Hawaii.

Does Hawaii Have State Capital Gains Tax. Hawaii collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Moreover what is the capital gains tax rate in Texas 2021.

Capital gains at all levels including long- and short-term ones. Capital gains are categorized as short-term gains a gain realized on an asset held one year or less or as. Short-term capital gains are taxed at the full income tax rates listed above.

745 Fort Street Suite 1614 Honolulu HI 96813. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. Short-term capital gains come from assets held for under a year.

Up to 20 cash back Selling condo capital gains no hawaii Im selling a property in hawaii and have a question about if the property - Answered by a verified Tax Expert. Use this calculator to estimate your capital gains tax. You will pay either 0 15 or 20 in tax on long-term capital gains which are gains that are realized from the sale of investment you held for at least one year.

During the first two years 5 will be charged and during the third year 5 will be charged. A 1031 exchange is a property swap of like-kind property. Hawaiis maximum marginal income tax rate is the 1st highest in the United States ranking directly.

Capital gains tax rates in Hawaii have been raised to 11 percent. There is good news for Hawaii residents. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Hawaii Financial Advisors Inc. In 2019 and 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. Bills have been introduced that could increase it further.

Capital gains tax is a 76 percent tax on capital gains in Hawaii. Capital gains tax in Hawaii is set to increase to 11 percent if legislation is passed. For complete notes and annotations please see the source below.

The Hawaii capital gains tax on real estate is 725. Long-term capital gains come from assets held for over a year. Five overlooked tax deductions to help manage your tax bill.

Deduction of 50 of capital gains or up to 1000 whichever is greater. Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20Capital Gain Tax Rates The tax rate on most net capital gain is no higher. Like the Federal Income Tax Hawaiis income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

In Hawaii the taxes you pay on long-term capital gains will depend on your taxable income and filing status. Capital Gains and Losses. In Hawaii long-term capital gains are taxed at a maximum rate of 725 while short-term capital gains are taxed at the full income tax rates listed aboveLong-term gains are those realized in more than one year.

A single person is exempt from capital gains tax with a gain of up to 250000 on the sale of their home and married couple with a gain of up to 500000 if they 1 owned the home for at least 2 years and 2 lived in the home as a primary residence for at least 2 of the past 5 years. Hawaiis capital gains tax rate is 725That applies to both long- and short-term capital gains. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10 12 22 24 32 35 or 37.

Hawaii Capital Gains Tax. The gains for which capital gains are recorded are long-term and short-term.

Harpta Firpta Tax Withholdings Avoid The Pitfalls Hawaii Living Blog In 2021 Tax Refund Hawaii Real Estate Tax

Testimony Sb2242 Aims To Hike Both Income And Capital Gains Taxes Grassroot Institute Of Hawaii

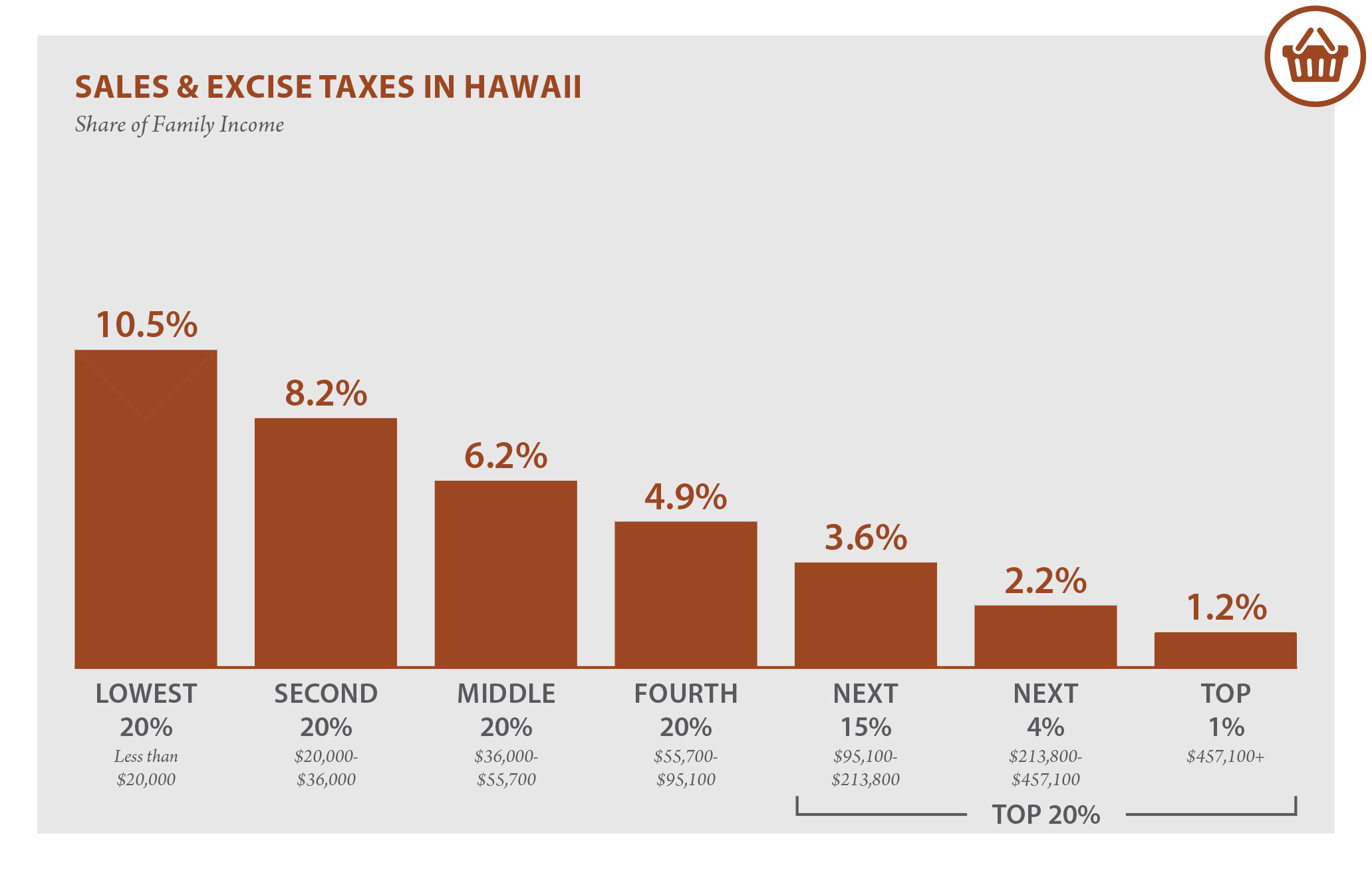

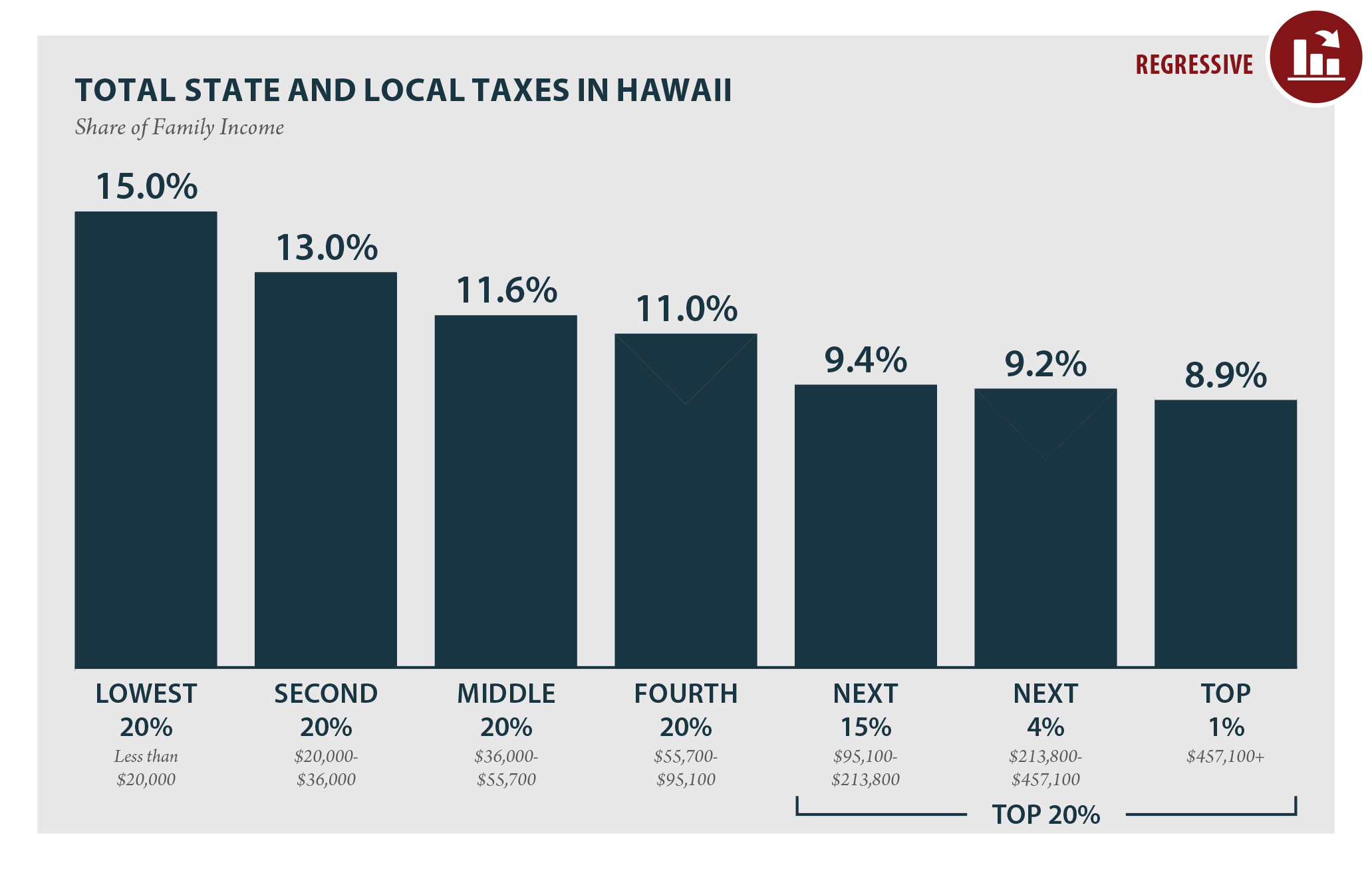

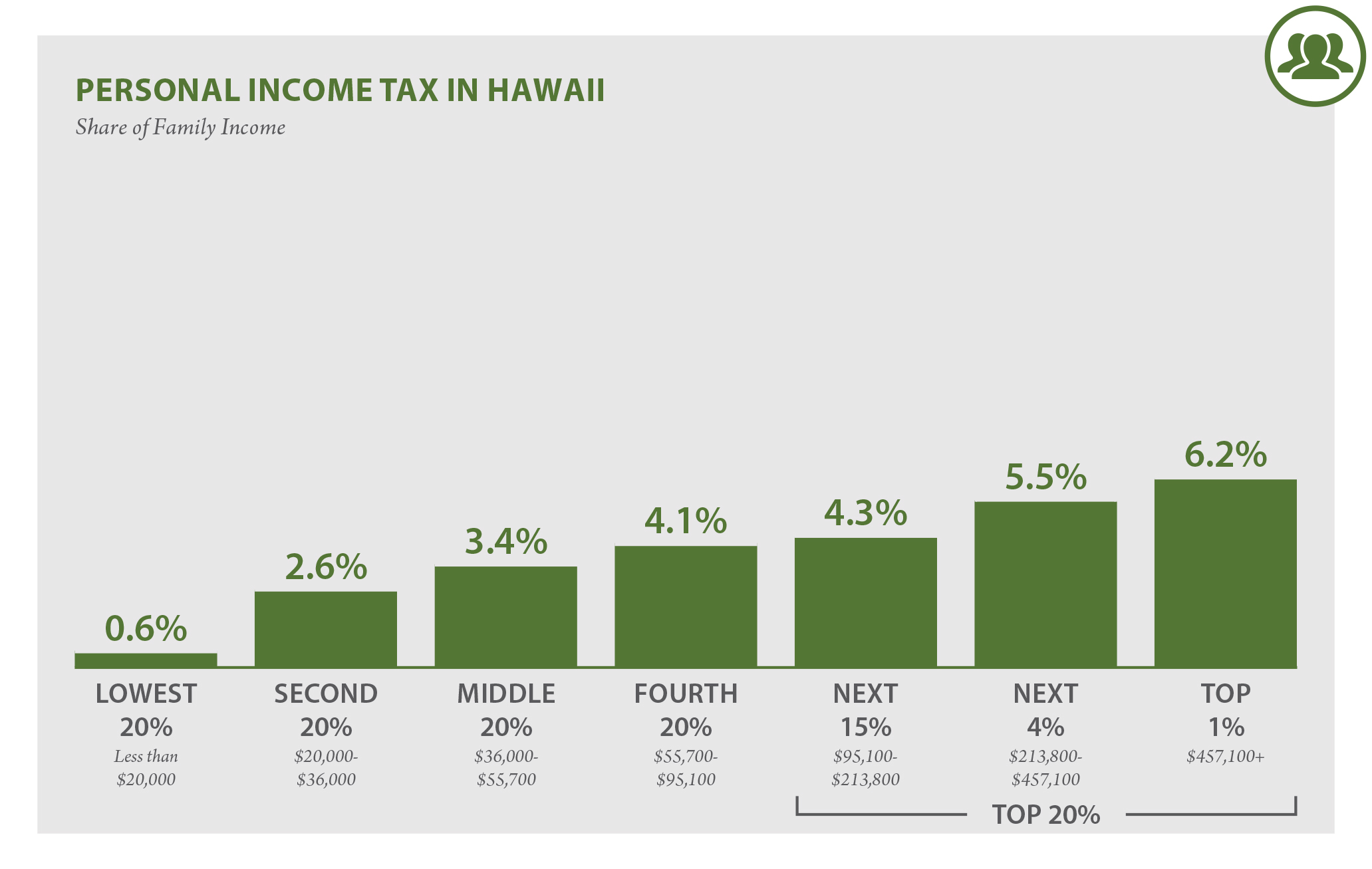

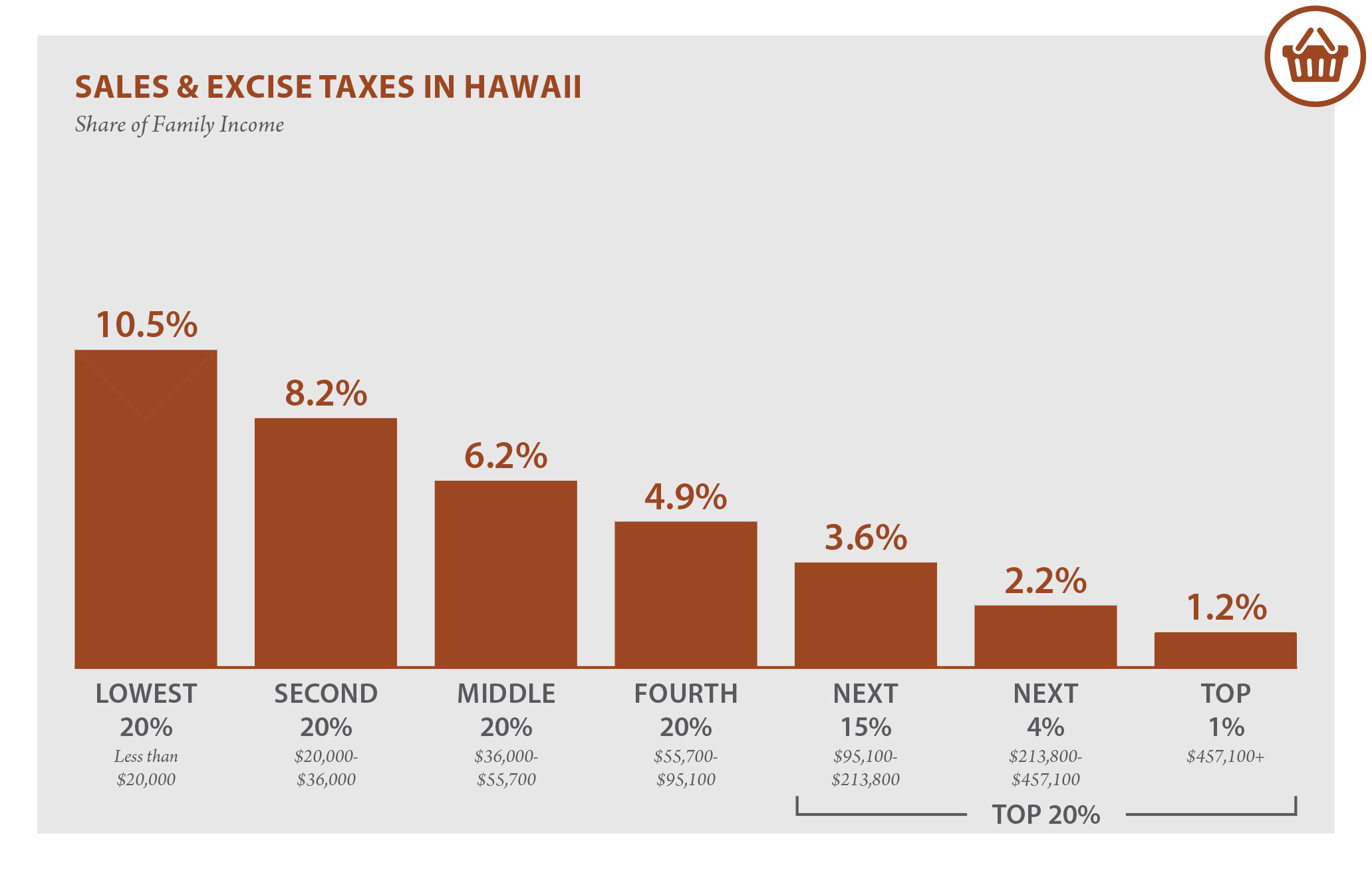

Hawaii Who Pays 6th Edition Itep

Historical Hawaii Tax Policy Information Ballotpedia

How High Are Capital Gains Taxes In Your State Tax Foundation

Hawaii Who Pays 6th Edition Itep

Hawaii Who Pays 6th Edition Itep

Pot Stock Watch List Stock Watch Investing Invest Wisely

Harpta Maui Real Estate Real Estate Marketing Maui

The Effect Of Capital Gain Tax Exclusions On Military Home Sellers Capital Gains Tax Capital Gain Military Relocation

Business Development And Support Division Tax Incentives And Credits

Cayman Corporate Offshore Services Provider Hermes Bvi Cayman Islands Island

Why No Fault Divorce Could Help Join The Dots Between Divorce Law And Tax Law Dominic Levent Solicitors Blog Family Law Social Media Leads Divorce Law

The Ultimate Guide To Hawaii Real Estate Taxes

Hawaii Income Tax Hi State Tax Calculator Community Tax

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Pin By The Agency Team Hawai I On Hawaii Real Estate In 2022 Hawaii Real Estate Big Island Estates

Contact Us Cayman Islands Corporate Services Provider Hermes Cayman Islands Cayman Hawaii Beaches