is there a renters tax credit

In others you need to make under a certain amount to get this deduction on your. How much is the credit.

Property Tax Credits Are You Eligible City Of Takoma Park

Check if you qualify.

. Dont miss out on this credit when you file your taxes. If you pay rent on your primary residence you might be able to claim a tax credit. The Rent Relief tax credit is applicable to all those who pay for private rented accommodation including houses and apartments.

In California renters who make less than a certain amount currently 41641. If your landlord is required to pay property tax on the rental unit in which you have lived for one full tax year then you have a good chance of qualifying for this Arizona tax credit. This included rent paid for flats apartments or houses.

You paid rent in California for at least 12 the year. The average monthly rent you and other members of your household paid was 450 or less not counting charges for heat gas electricity furnishings or board. If you work and meet certain income guidelines you may be eligible.

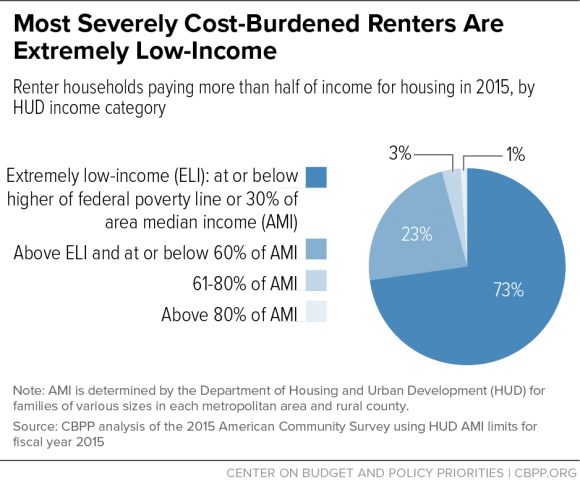

A portion of your rent is used to pay property taxes. With an adjusted gross income OR the total of. These are awarded only on the state levelthere is no federal renters tax credit.

Applies credits per person for unmarried individuals and per couple for. There is not a rent deduction or credit on your Federal return. Get the credit you deserve with the earned income tax credit EITC.

Aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year. Up to 31 December 2017 you could claim a tax credit if you paid for private rented accommodation. You may be able to claim this credit if you paid rent for at least 12 the year.

The 2019 earnings limits are 42932. This bill allows owners of rental buildings who provide reductions in rent to their low-income tenants a refundable tax credit for a specified. Renters Tax Credit Application Form RTC 2022 The State of Maryland provides a direct check payment of up to 100000 a year for renters who paid rent in the State of.

You may qualify for a Renters Property Tax Refund depending on your income and rent paid. From there you can deduct a portion of your rent on your taxes. A credit for taxpayers.

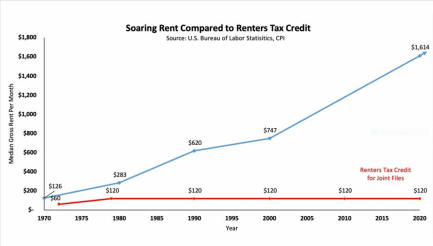

Rent Tax Credit. The amount of the renters tax credit will vary according to the relationship between the rent and income with the maximum allowable credit being 1000. Renters in California may qualify for up to 120 in tax credits.

The New York City enhanced real property tax credit can get renters up to 500 back on their New York State tax returns. Renters Tax Credit Act of 2021. Each state has its own regulations around a renters tax credit.

A bill to amend the Internal Revenue Code of 1986 to provide a refundable tax credit to taxpayers who provide reductions in rent to their. Establishes a 500 supplemental tax credit for renters who are eligible for the existing renters credit. All of the following must apply.

Tax back on rent relief can only be claimed. And it only applies if you rent your. Youll need to figure out how much space your home office takes up within your rental.

If your state has anything for renters you will be prompted to enter your rent info when you complete your state return. Renters Property Tax Refund. Renters Tax Credit Act of 2021.

In many states the renters tax credit is limited to those over a certain age or with a disability. A renters tax credit allows taxpayers who rent their homes to receive a credit on their annual tax return based on your total rent payment. The Low-Income Housing Tax Credit LIHTC program helps create affordable apartment communities with lower than market rate rents by offering tax incentives to the property.

That being said each state has its own unique set of rules and we get into these specifics below. Say your apartment is. As far as I.

%20(1)-page-002.jpg?width=720&watermark=&hash=klaf2w5hY6T9FeuLAJmsCHWZ3g8v7VA2345F1F-PDzM)

Baltimorejewishlife Com Time To Submit Homeowners Renters Tax Credit Applications Has Been Extended

Under Us Housing Policies Homeowners Mostly Win While Renters Mostly Lose

The Fair Tax Credit A Proposal For A Federal Assistance In Rental Credit To Support Low Income Renters Terner Center

Tax Credits For Renters Could Increase Racial And Economic Equity Urban Institute

Families Paying Off Rent Food Debts With Child Tax Credit Pbs Newshour

Josh Becker On Twitter Ca Renters Are Caught Between Soaring Costs To Keep A Roof Over Their Heads Amp The Scarcity Of Affordable Housing No One Feels The Squeeze As Much As

Homeowners And Renters Tax Credit Applications Now Available Online City Of Laurel Maryland

Efile Express Mn Property Tax Refund

Pennsylvania Budget Has New Tax Credits Rebates

Forgotten Credits Could Save Renters Homeowners Hundreds A Year

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News

Tax Time For Renters Requesting A Rent Certificate T R Mckenzie Apartments

How To Apply For A Pennsylvania Property Tax Rebate Or Rent Rebate Pittsburgh Post Gazette

Debating A Renters Tax Credit At The Federal Level Planetizen News

Rental Property Tax Deductions A Comprehensive Guide Credible

Senator Becker Coauthors Bill To Update California S Decades Old Renters Tax Credit To Aid Low Income Residents Senator Josh Becker

Property Tax Credits Are You Eligible City Of Takoma Park

Three Tax Deductions For Renters Irvine Company Apartments

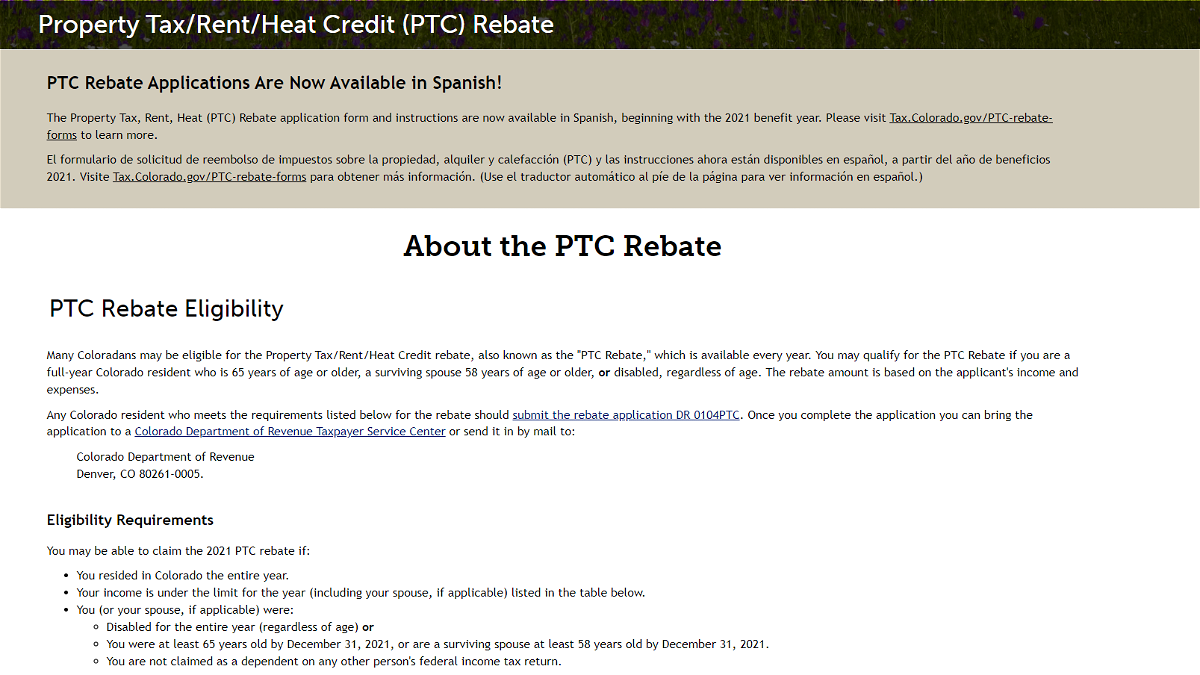

Colorado Residents Can Now Apply For Rebate To Help With Property Tax Rent Heat Expenses Krdo